What were the biggest biopharma stories of 2019?

The biggest stories and trends of 2019 - mega-mergers, regulatory controversies, the national conversation about drug pricing and more - will likely have implications for 2020 as well.

The biggest stories and trends of 2019 - mega-mergers, regulatory controversies, the national conversation about drug pricing and more - will likely have implications for 2020 as well.

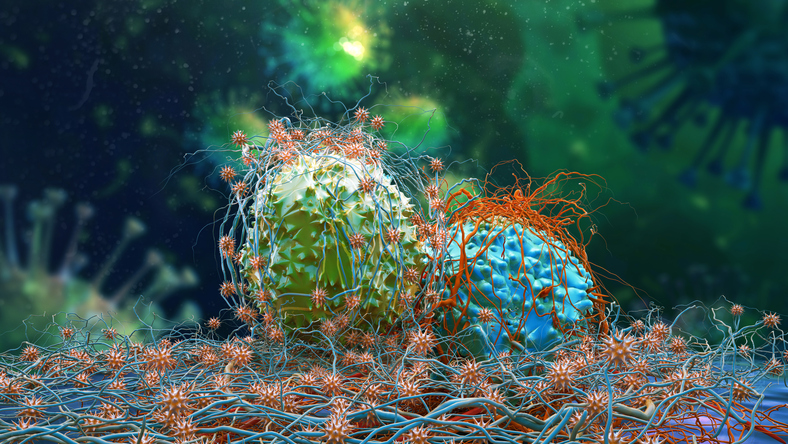

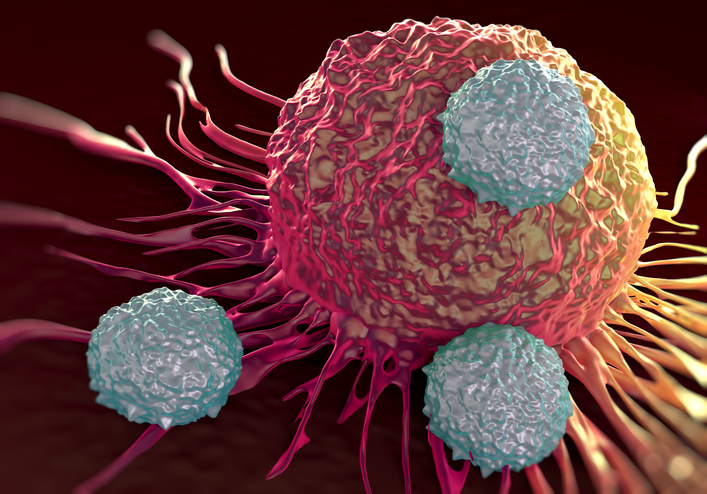

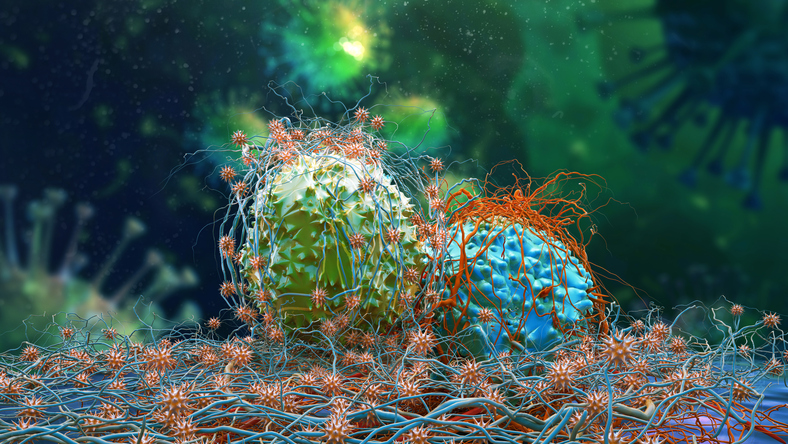

In data from several clinical trials released Friday and during the weekend, cell and other therapies for multiple myeloma targeting the antigen BCMA showed strong response rates.

Deal value for the third quarter fell sharply from what it was in the first and second quarter, but that was due to the absence of the large acquisitions that took place earlier this year rather than an overall downward trend.

Nine senators sent a letter to FTC Chairman Joseph Simons urging greater scrutiny over like the one between BMS and Celgene, expressing concern over antitrust issues, innovation and drug pricing.

Celgene will have opt-in rights to take responsibility for development, manufacturing and commercialization of T-cell receptor therapies that Immatics develops using its in-house technology.

Bristol-Myers Squibb said Celgene would sell the drug, Otezla (apremilast), to Amgen. The pharmaceutical company had said it would seek a divestment of the drug to satisfy competition concerns from the FTC.

The agency said Friday that it had approved Celgene's Inrebic (fedratinib), the first new drug approved for the disease - a type of rare blood cancer - since the approval of Incyte's Jakafi.

Celgene plans to file for approval of bb2121 (idecabtagene vicleucel) in myeloma in the first half of 2020, and lisocabtagene maraleucel in lymphoma in the fourth quarter of this year.

The drugmaker said Monday it would sell off the drug Otezla to address concerns about competition that the Federal Trade Commission had expressed in connection to the pending $74 billion deal. According to an analyst, BMS saw Otezla as competitive against its investigational TYK2 inhibitor.

Celgene had been expected to hand the PD-1 checkpoint inhibitor tislelizumab back over to the Chinese company due to its $74 billion acquisition by Bristol-Myers Squibb, which already has its own well-established PD-1 inhibitor, Opdivo.

In a landscape where complexity has long been the norm, the power of one lies not just in unification, but in intelligence and automation.

The KEYNOTE-119 study failed to show a survival benefit in TNBC patients. The news comes two months after the FDA gave accelerated approval to a rival, Roche's Tecentriq.

In a statement, the agency said that a decision on whether to have Medicare cover the cell therapies would not be issued Friday, but would be forthcoming.

The agency also proposed increasing the maximum new technology add-on payment from 50 percent to 65 percent for fiscal year 2020.

The company has raised more than $100 million since 2017 and plans to use the current funding to build a pipeline of RNA-targeting small molecules.

BMS's acquisition of Celgene had attracted opposition from two institutional investors. However, one of them withdrew its effort to derail the deal despite continuing to voice opposition.